child tax credit november 2021 late

Its not too late you can still file your tax return to get the Child Tax Credit and thousands of dollars of additional tax benefits. Some parents may see smaller child tax credit payments for the rest of 2021.

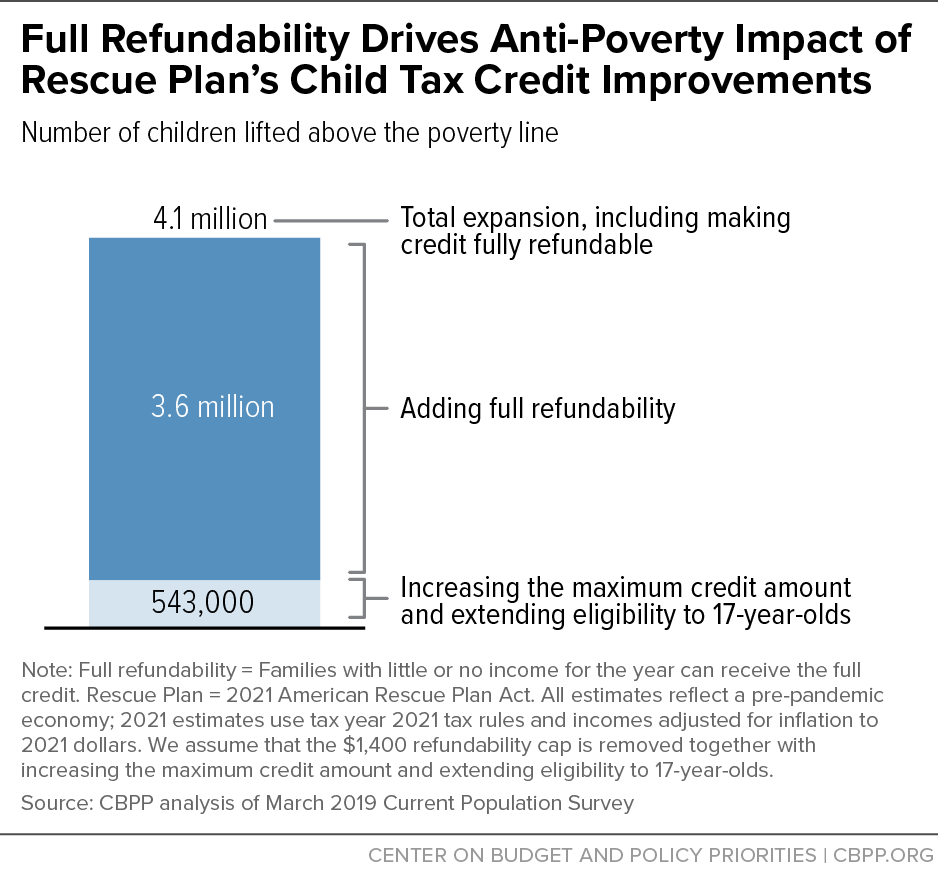

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

. Last week the federal tax agency. Some parents may see smaller child tax credit payments for the rest of 2021. To start a trace complete Form 3911 and fax or mail it in.

November 15 2021. SOME families who signed up late to child tax credits will receive up to 900 per child this month. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in.

To help families plan ahead the IRS also announced today that in late November it will launch a new Spanish-language version of the CTC UP. If Congress doesnt extend it the Child Tax Credit would revert to its. Households on low incomes can still claim advance payments until.

13 hours agoMore than 9 million individuals and families could be leaving money on the table by not filing a 2021 federal tax return according to the IRS. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Some parents may see smaller child tax credit payments for the rest of 2021.

Its too late to un-enroll from the November payment as the IRS deadline to opt out was on November 1. Instructions on where to send it are at the bottom of the form. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their.

Of families will receive 3000 per child ages. The Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the. 422 AM PST November 14 2021.

The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15. The credit is 3600 annually for children under age 6 and. This caused about 2 of child tax credit recipients to not.

Some parents may see smaller child tax credit payments for the rest of 2021. This caused about 2 of child tax credit recipients to not. Some parents may see smaller child tax credit payments for the rest of 2021.

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. It is key to the Bidens. The November advance child tax credit payment comes Monday to millions of Americans.

November 12 2021 1226 PM CBS Pittsburgh. The IRS has created a special. This caused about 2 of child tax credit recipients to not.

This caused about 2 of child tax credit recipients to not. Advance payments of the enhanced child tax credits were sent to people from July to December 2021. 722 AM EST November 14 2021.

There are a number of changes to the CTC in 2021 because of the American. 722 AM EST November 14 2021. This caused about 2 of child tax credit recipients to not.

722 AM EST November 14 2021. The deadline for this money is also fast approaching people who qualify have to file their information by. Changes in income filing status the birth or.

722 AM EST November 14 2021. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. The monthly payments were up to 250 or 300 per child for a period of.

Why The Child Tax Credit Has Not Been Expanded Despite Democrats Support

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Last Monthly Child Tax Credit Of 2021 Is Being Distributed

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Stimulus Update You May Get A Smaller Child Tax Credit Payment Today Here S Why Gobankingrates

Here Is Why You May Want To Opt Out Of Child Tax Credit Early Payments

The Economy Page 2 Of 18 Unidosus

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit November Payments Set To Go Out Monday Could Be Next To Last Unless Congress Extends Program Abc7 Chicago

Families Are Using New Child Tax Credit For K 12 School Costs Census Shows Education Next

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

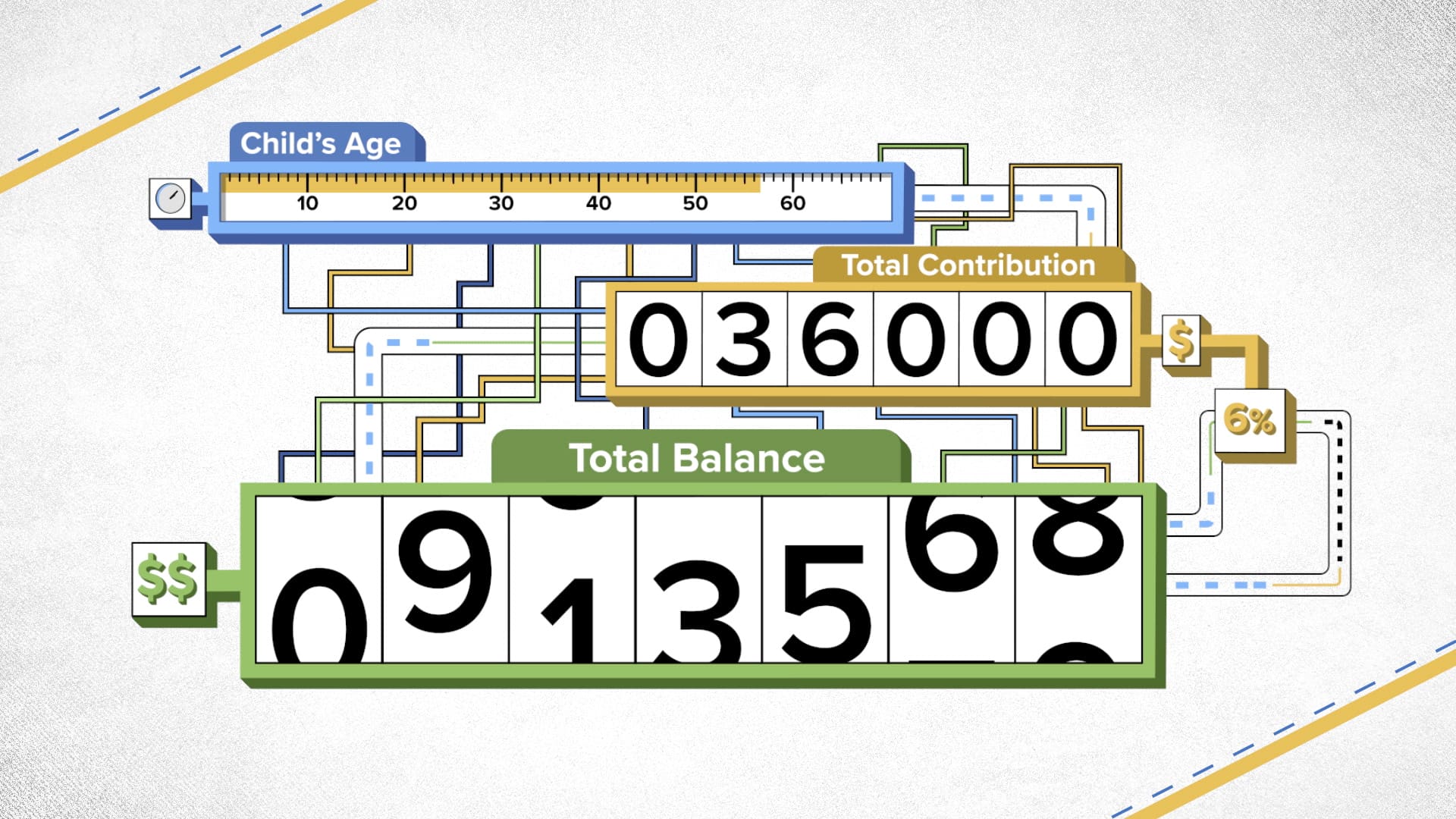

Signing Up Late For The Child Tax Credit Means Fewer Larger Checks

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Child Tax Credit 2021 What To Know About New Advance Payments